Begini Rumus Perhitungan Zakat Harta dalam Islam

Nisab emas dan perak adalah 20 dinar (85 gram emas murni) dan perak adalah 200 dirham (setara 595 gram perak). Artinya, apabila seseorang telah memiliki emas atau perak sebesar 20 dinar atau 200 dirham dan sudah memilikinya selama setahun, maka ia terkena kewajiban zakat sebesar 2,5%. Demikian juga jenis harta yang merupakan harta simpanan dan.

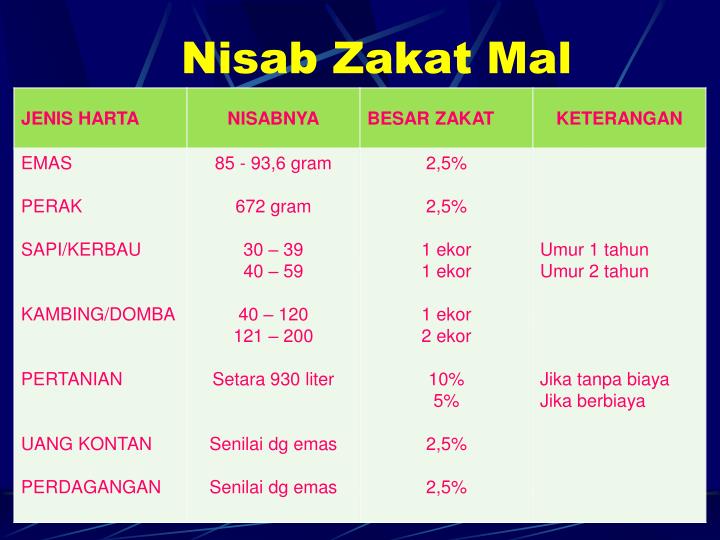

Jenis Zakat Mal, Nishab, dan Kadar Zakat

SUBTOTAL = or > nisab (current price of gold per gram x 85 gm) SUBTOTAL x .025 = due zakat. When P WEALTH and B WEALTH equal nisab thresholds separately, one pays Zakat on their sum total at .025 percent. If subtotals for P WEALTH and B WEALTH streams are less than nisab separately, but equal to or greater than the nisab threshold together, one.

Nisab and Zakat Calculation in a Nutshell Zakat Foundation of America

The government has announced the Nisab-i-Zakat for the Zakat Year 1444-45 A.H, the minimum amount in bank accounts on which zakat will be deducted on the eve of first Ramazan, The Ministry of Poverty Alleviation and Social Safety (PASS) notified the new Nisab at Rs. 135,179.

Nisab Zakat Adalah Pengertian, Cara Menghitung hingga Jenisnya Akseleran Blog

1970 - 2022. Nisab refers to the current price/rate of 86 grams of gold. The Nisab value informs Muslim of whether they are eligible to fulfil Zakat or not. This is because Nisab is the minimum amount that one should have before they are required to fulfil Zakat. Upon meeting the Nisab value, one should maintain this amount for 1 Hijri year (or.

Inilah Besarnya Nisab Zakat Maal yang Harus Kamu Ketahui Dompet Dhuafa

Nisab zakat maal: 85 gram emas. Kadar zakat maal: 2,5%. Cara menghitung zakat mal. Sebagaimana dicontohkan oleh Badan Amil Zakal Nasional di laman resminya, perhitungan zakat mal adalah sebagai berikut: 2,5% x Jumlah harta yang tersimpan selama 1 tahun.

Penentuan Nisab Zakat Mal Berdasarkan Hartanya

Nisab is the minimum amount that a Muslim must have before being obliged to zakat. The Nisab was set by Prophet Muhammad (peace be upon him) at a rate equivalent to: 87.48 grams of gold and 612.36 grams of silver. As we no longer use silver or gold as currency, you need to find out the equivalent monetary exchange value of the rates the Prophet.

Islamic Ministry announces Nisab applied on ZakatalMal

Mencapai nisab jadi syarat wajib zakat mal. Yang dimaksud dengan nisab adalah syarat batas minimum harta yang dapat dikategorikan sebagai harta wajib dizakati. Syarat nisab adalah setara dengan harga 85 gram emas atau 595 gram perak. 4. Melebihi kebutuhan pokok.

Islamic Ministry increases Nisab for Zakat alMal 2022 The Times of Addu

Nisab. In Sharia (Islamic Law) niṣāb (نِصاب) is the minimum amount of wealth that a Muslim must have before being obliged to give zakat. Zakat is determined based on the amount of wealth acquired; the greater one's assets, the greater the zakat value. Unlike taxable income in secular states, niṣāb is not subject to special exemptions.

Nisab of ZakatalMal rises The Edition

Zakat penghasilan atau yang dikenal juga sebagai zakat profesi; zakat pendapatan adalah bagian dari zakat mal yang wajib dikeluarkan atas harta yang berasal dari pendapatan / penghasilan rutin dari pekerjaan yang tidak melanggar syariah. Nishab zakat penghasilan sebesar 85 gram emas per tahun. Kadar zakat penghasilan senilai 2,5%.

Who is Eligible for Zakat? What is Nisab? Nisab 2020 YouTube

"Al mal" in zakat al mal means whatever is acquired for its benefit and has a monetary value. However, for the purpose of this article we will limit the meaning of it to the zakatable items. The most popular and common zakat asset people are familiar with is wealth.. As long as it does not go below the nisab, by the end of the zakat year.

Nisab What is Nisab? Islamic Relief Australia

Zakat al Mal Nisab. The Nisab threshold determines the minimum amount of wealth required for Zakat al-Mal to be obligatory. Calculated based on the market price of silver or gold, it ensures that Zakat is levied on surplus wealth rather than regular income. The Hanafi school sets the nisab at 612.36 grams of silver, while other schools consider.

Berapa Nisab Zakat Profesi Homecare24

1. Zakat Emas dan Perak. Apabila emas dan perak yang dimiliki telah mencapai haul (satu tahun) dan nisabnya, maka telah wajib dikeluarkan zakatnya. Adapun nisab emas sebesar 85 gram emas, sementara nisab perak sebanyak 595 gram perak. Dan muslim harus mengeluarkan zakat sejumlah 2,5% dari harta emas dan perak yang dimiliki.

Zakat How To Calculate Your Nisab? Here's A Complete Guide

Nisab is the minimum amount of wealth a Muslim must have—after calculating necessary expenses—to be eligible to contribute zakat. Nisab is equivalent to the current value of 3 ounces of gold (or 85 grams of 24k gold). The nisab we've calculated for our zakat calculator is based on the most-recent report available to us (disclaimer: this number may change daily depending on fluctuations.

Nisab Dan Kadar Zakat Mal Contoh Surat Resmi

The Concept of Zakat Al-Mal. Zakat Al-Mal is an obligatory form of almsgiving in Islam, representing a systematic approach to wealth purification and societal welfare. The term "Zakat" is derived from the Arabic root word meaning 'to purify' or 'to cleanse.'.

Ketahui Syarat Wajib Zakat Mal Beserta Haul dan Nisabnya, Lengkap!

IslamicFinder Online Zakat Calculator 2024 provides you a step by step method to calculate Zakat on your assets.. Step 1: Enter the Value of Nisab in your local currency. According to Sharia Law, Nisab is the minimum amount a person possesses for over a year in order to be obliged to pay Zakah.You can calculate nisab in terms of either Gold or Silver value.

Nisab of zakat almal lowered International

NiSAb Defined. Niṣâb is the Arabic word that names the minimum quantity the Prophet, on him be peace, set as a fixed threshold at which a Muslims must pay Zakat from eligible wealth. Different types of assets have different specified thresholds. Literally, niṣâb means "origin" because the right of the poor and Zakat-worthy on one's.