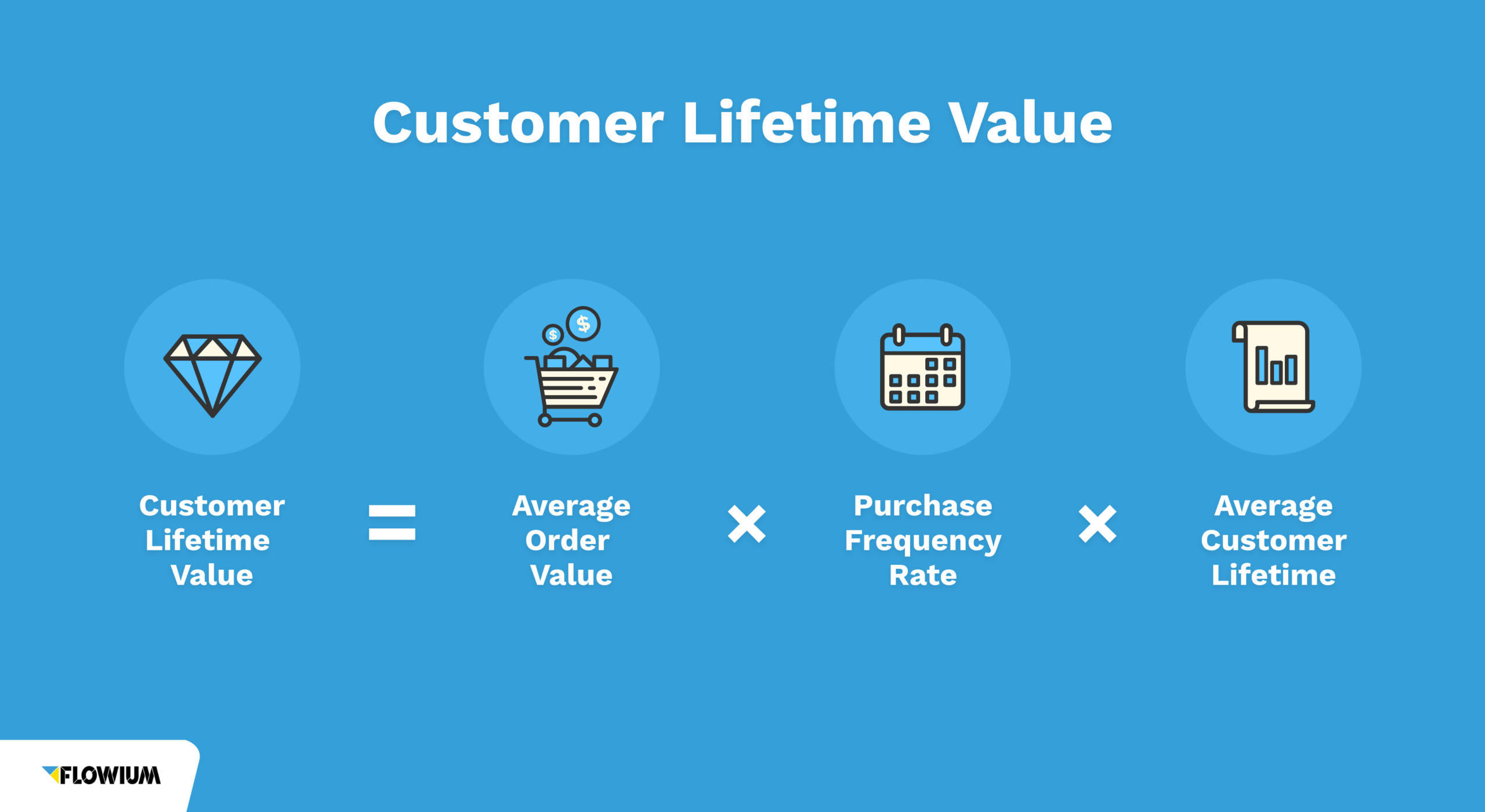

Understand, Calculate, and Increase Your Customer Lifetime Value (CLV) Flowium

Examples of LTV ratios. The loan-to-value (LTV) ratio is a metric to measure the financial risk of a loan. It compares the amount of money borrowed to the market or appraised value of the asset.

Pembuktian Rumus Gerak Lurus Berubah Beraturan (GLBB) dalam fisika Master Matematika Fisika

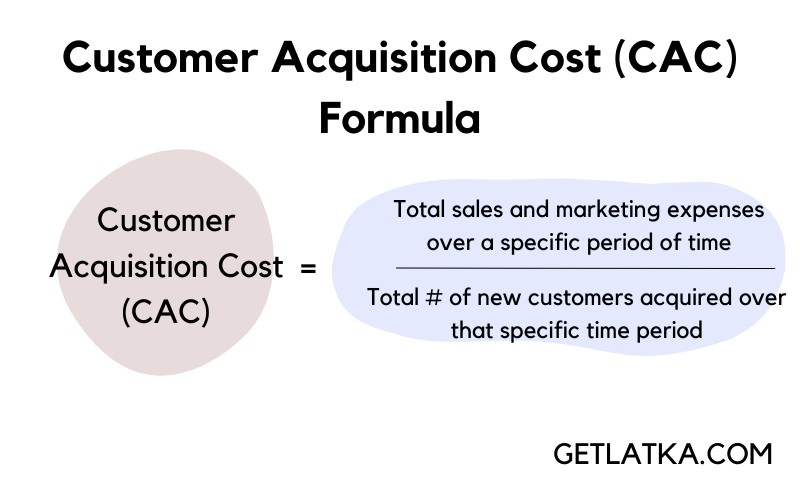

The formula for the loan to value ratio is the loan amount divided by the value of the collateral used for the loan. The formula for the loan to value ratio is most commonly referenced in auto loans and mortgages, but can be applied to any loan that is secured with collateral including boat loans, RV loans, and certain types of commercial loans.

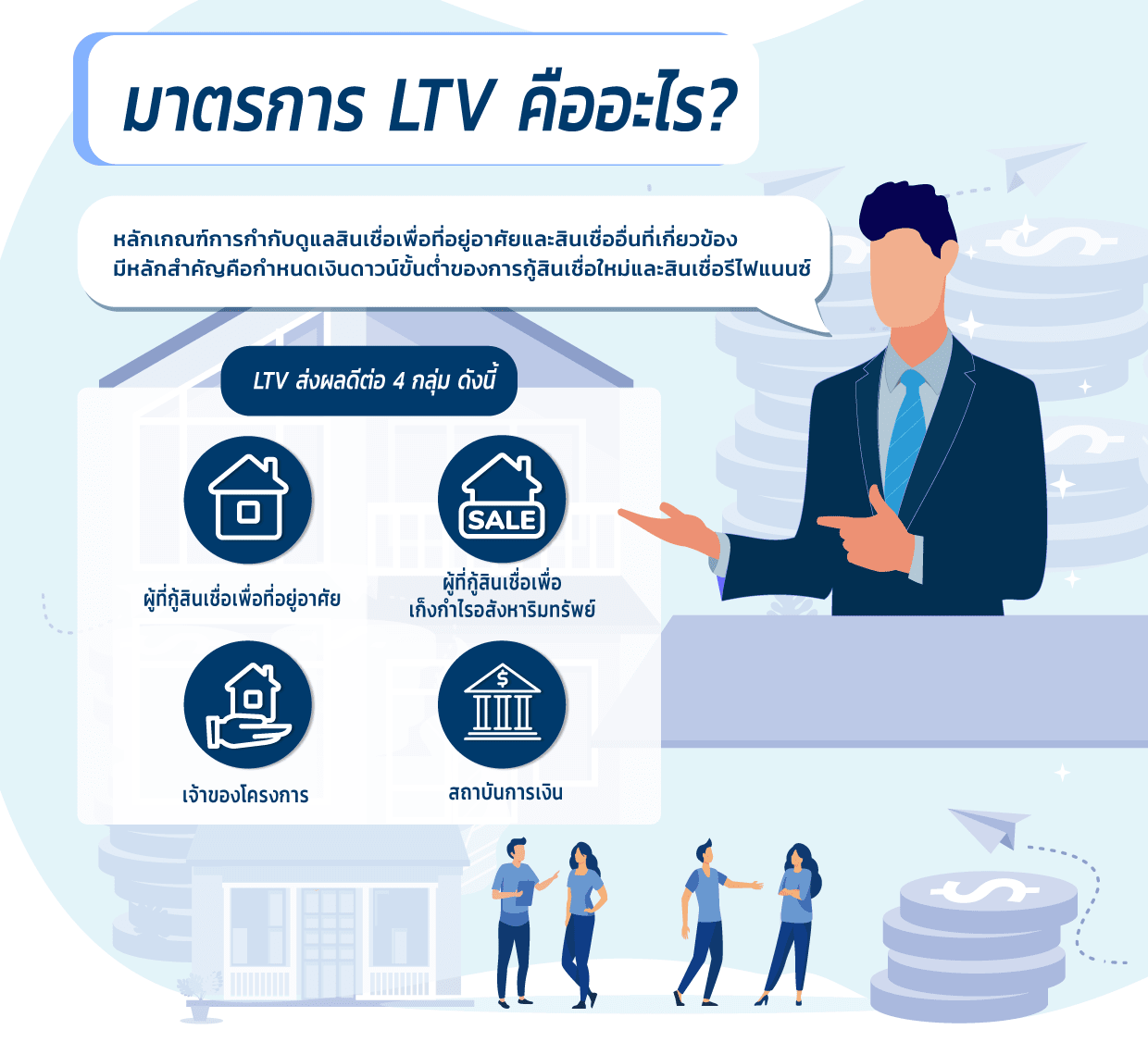

ส่องเกณฑ์ใหม่อัตราส่วนการปล่อยสินเชื่อบ้าน (LTV) คลอดแล้ว มีอะไรบ้าง

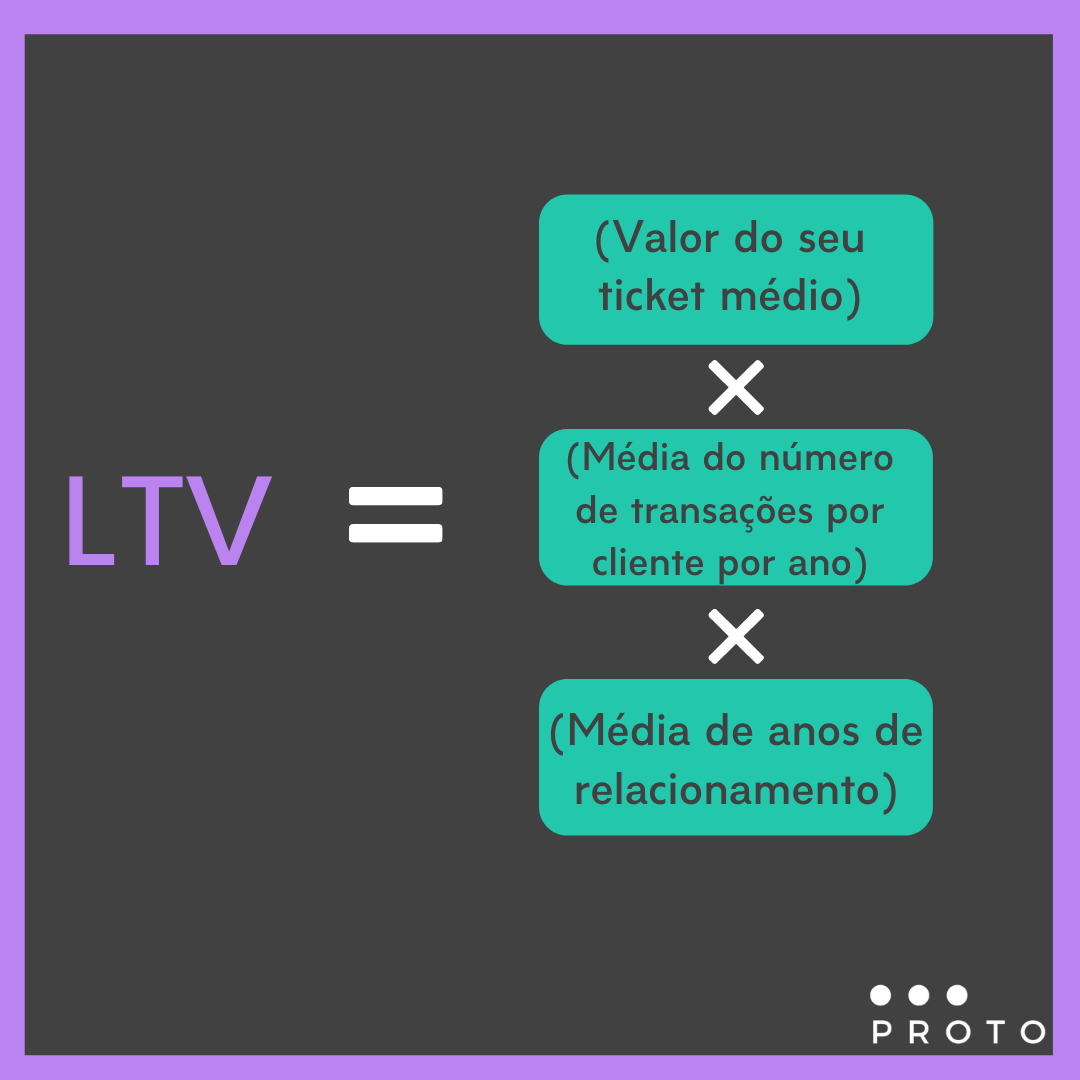

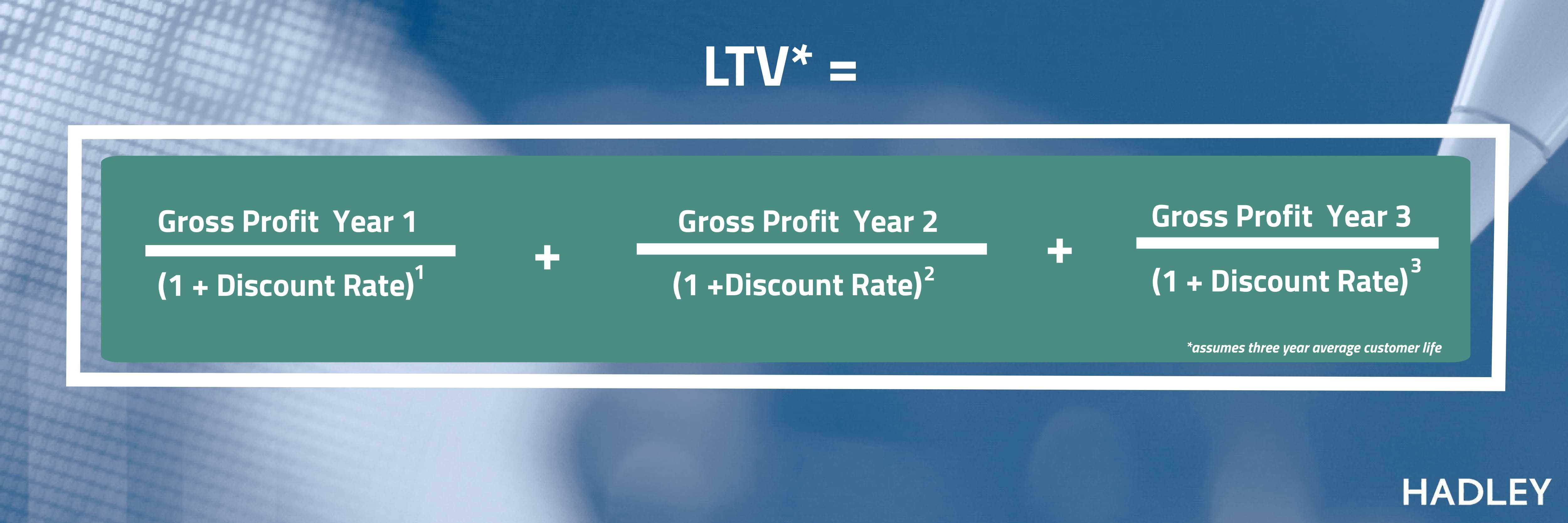

4.9. Top #1 E-Commerce Analytics Software. Top #1 Google BigQuery Add-on for Google Sheets. Top #2 Easiest To Use Marketing Analytics Software. PDF 1.05 Mb. Learn simple ways to calculate Customer Lifetime Value (LTV) and optimize your business for growth, profits, and budget efficiency.

Rumus Segitiga Sama Sisi Sifat Keliling Luas Dan Contoh Soal Riset

Loan-to-Value Ratio (LTV) = $320,000 ÷ $400,000 = 80.0%. Equity Contribution = $80,000 ÷ $400,000 = 20.0%. The 80% loan-to-value ratio (LTV) implies the bank lender is funding 80% of the total purchase price in the form of a secured mortgage loan, while the remaining 20.0% is contributed by the real estate investor.

Begini Cara Menghitung Npv Rumus Dan Contohnya My XXX Hot Girl

Rumus Perhitungan Rasio LTV . Loan To Value adalah kebalikan dari uang muka peminjam. Misalnya, peminjam yang memberikan uang muka 20%, maka LTV-nya 80%. Adapun rumus LTV dihitung dengan membagi jumlah hipotek dengan nilai penilaian rumah/properti yang dibeli. Rumusnya dapat ditulis dalam persamaan berikut ini :

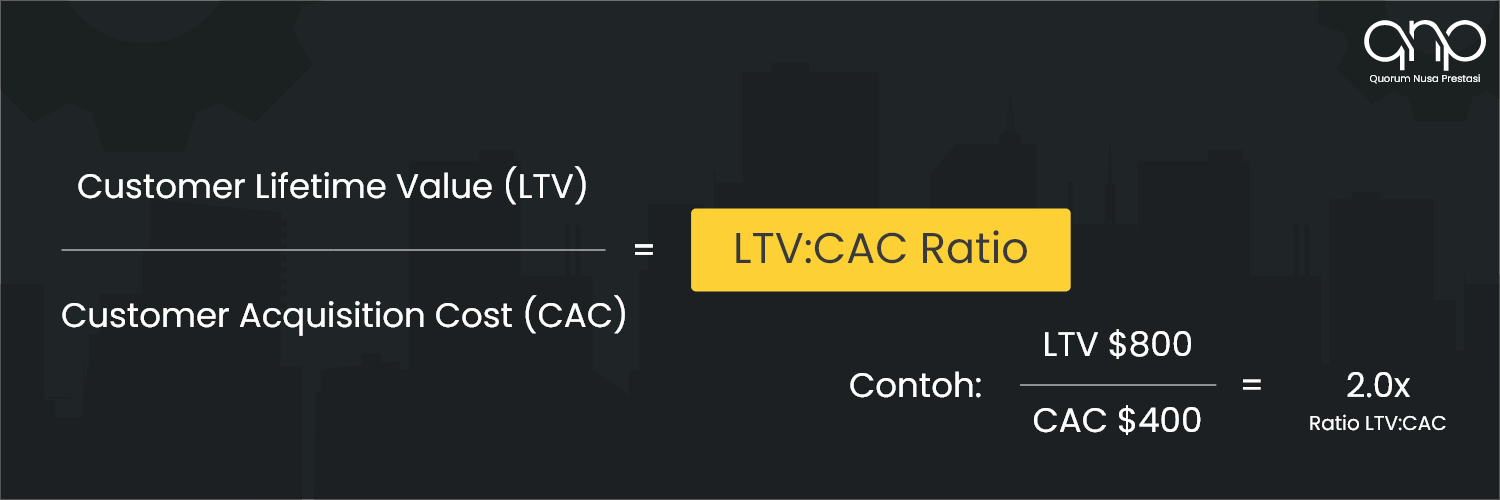

LTVCAC Ratio KPI example Geckoboard

Loan-To-Value Ratio - LTV Ratio: The loan-to-value ratio (LTV ratio) is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage.

Rasio Loan To Value Adalah Rumus, Cara Hitung, dan Contohnya

A loan-to-value (LTV) ratio is used by lenders to help determine the financial risk of a mortgage. To find the LTV ratio of a mortgage, divide your current balance by the appraised value of the related property and multiply the answer by 100 to get a percentage.

Apa itu Rasio LTVCAC? Quorum Nusa Prestasi

The Loan to Value Calculator uses the following formulas: LTV = Loan Amount / Property Value. Where, LTV is the loan to value ratio, LA is the original loan amount, PV is the property value (the lesser of sale price or appraised value). CLTV = All Loan Amounts / Property Value = ( LA 1 + LA 2 +. + LA n ) / Property Value.

LTV CAC Ratio Definition, Formula & Example

Baca juga: Current Ratio (Rasio Lancar): Pengertian, Rumus, Contoh dan Batasannya. Rumus Menghitung Loan to Value. Menghitung besarnya rasio LTV bisa dilakukan dengan membagi jumlah pinjaman dengan nilai agunan hasil appraisal. Nilai appraisal sendiri biasanya diberikan oleh analis properti dari pihak bank dan Kantor Jasa Penilai Publik (KJPP).

Rumus Keliling Lingkaran Dan Contoh Soalnya Riset

LTV = ARPU (average monthly recurring revenue per user) × Customer Lifetime. You can also calculate lifetime value using churn (which is a number you likely have more readily available). LTV = ARPU / User Churn . The higher your user churn, the lower your lifetime value will be. You can see why paying attention to both LTV and churn is so.

อัปเดตมาตราการ LTV ปี 2023 เรื่องต้องรู้ก่อนกู้ซื้อบ้าน

LTV gabungan memiliki rumus sederhana. Ini dia - CLTV = Pinjaman 1 + Pinjaman 2 / Nilai Total Properti. Mari kita hitung LTV Gabungan untuk Bank A sekarang - (200.000 + 50.000) / 400.000 = 62,5%. Sekarang LTV ini jauh lebih rendah. Biasanya, jika peminjam memiliki skor kredit yang baik, maka bank mengizinkan LTV lebih dari 80%.

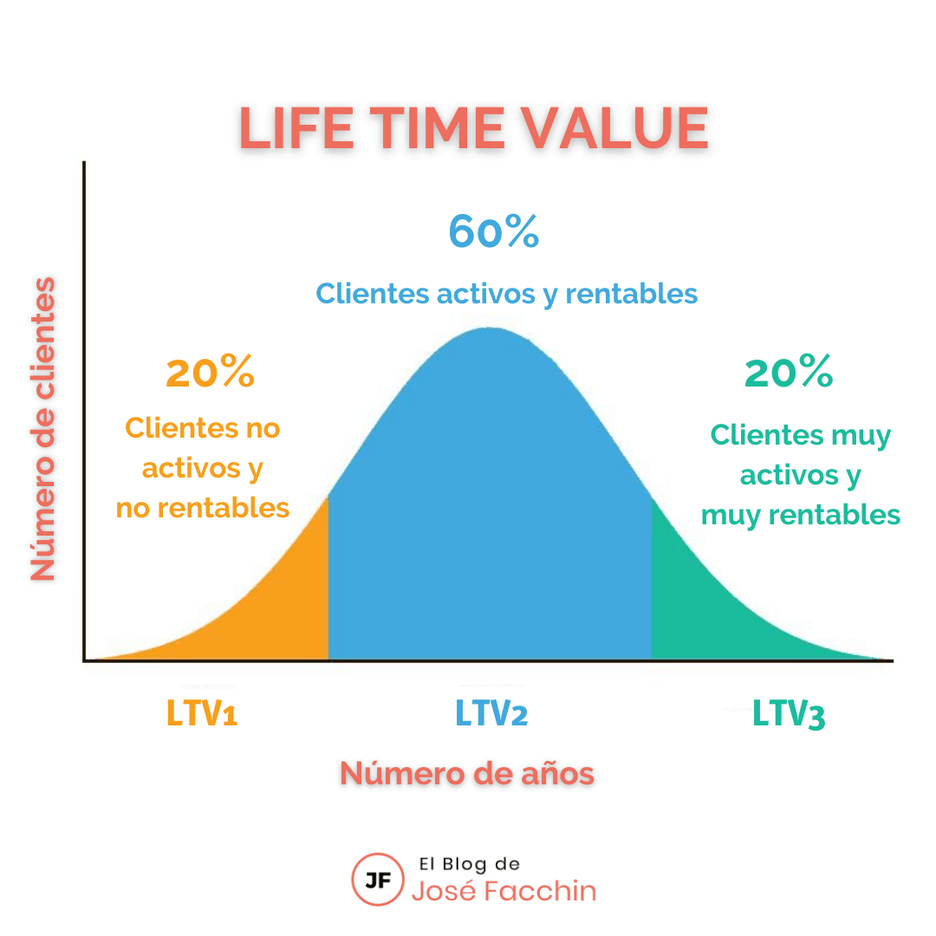

LTV o Lifetime Value ¿Qué es y cómo se calcula?

Typically, lifetime value (LTV) calculates the overall value of all customers. But customer lifetime value (CLV) can also focus on the business value of specific customers or groups of customers. The formula above is the standard formula to calculate CLV. But finding this important figure can be more complicated than it looks.

Relação CAC x LTV Entenda a importância dessas métricas para sua área de vendas by Vitor

The LTV would be the loan amount of $160,000 divided by the appraised value of $200,000, which is 0.80, or 80%. Your LTV is 80% of the property's value. Your LTV ratio can be one indicator of whether you can afford the home or vehicle you want. Why your LTV ratio matters. The higher your LTV ratio, the riskier your loan may appear to lenders.

How To Calculate a Customer’s Lifetime Value [Ultimate Guide]

Rumus Loan to Value Foto: outlook. Rumus LTV sendiri adalah kebalikan dari uang muka pinjaman, misalnya ketika si peminjam akan memberikan uang muka sebesar 20%, maka LTV yang didapatkan yaitu sebesar 80%. Caranya, Anda bisa membagi jumlah hipotek dengan harga penilaian rumah ataupun properti yang akan kita beli. Rumusnya sendiri, yaitu:

Cara Membuat Rumus Standar Deviasi Di Word IMAGESEE

Ringkasan Latar Belakang Pengaturan:. Bank Indonesia melakukan penyesuaian pengaturan batasan Rasio Loan to Value (LTV) untuk Kredit Properti (KP), batasan Rasio Financing to Value (FTV) untuk Pembiayaan Properti (PP), dan batasan Uang Muka untuk Kredit atau Pembiayaan Kendaraan Bermotor (KKB/PKB) melalui penerbitan Peraturan Bank Indonesia Nomor 23/2/PBI/2021 tentang Perubahan Ketiga atas.

Rumus Beda Potensial atau Tegangan (2)

The collateral coverage ratio is the percentage of a loan that's secured by a discounted asset. This ratio is calculated by the collateral coverage ratio formula, which is the discounted collateral value divided by the total loan amount. The lower the ratio, the higher the risk for lenders; the higher the ratio, the lower the risk for lenders.